Depreciation rate calculation formula

Taxpayer a single filer has wages of 180000 and 15000 of dividends and capital gains. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear.

Depreciation Rate Formula Examples How To Calculate

Double-Declining Method Depreciation Double-Declining Depreciation Formula To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life.

. Take the second part of the future appreciation formula and substitute the values in the formula for the values you know. Guide to Straight Line Depreciation formula. Determine the useful life of the.

Accounting Rate of Return Formula Calculation Step by Step Accounting Rate of Return ARR Average Annual Profit Initial Investment. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates. Read more which can be calculated as per below.

Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below. They can employ Accelerated depreciation is a way of.

Years Average Life of Assets. The straight line calculation steps are. Now we need to find out the rate of depreciation based on useful life.

Its value indicates how much of an assets worth has been utilized. 3 Double Declining Balance Method. In other words if we have dependent variable y and independent variable x in.

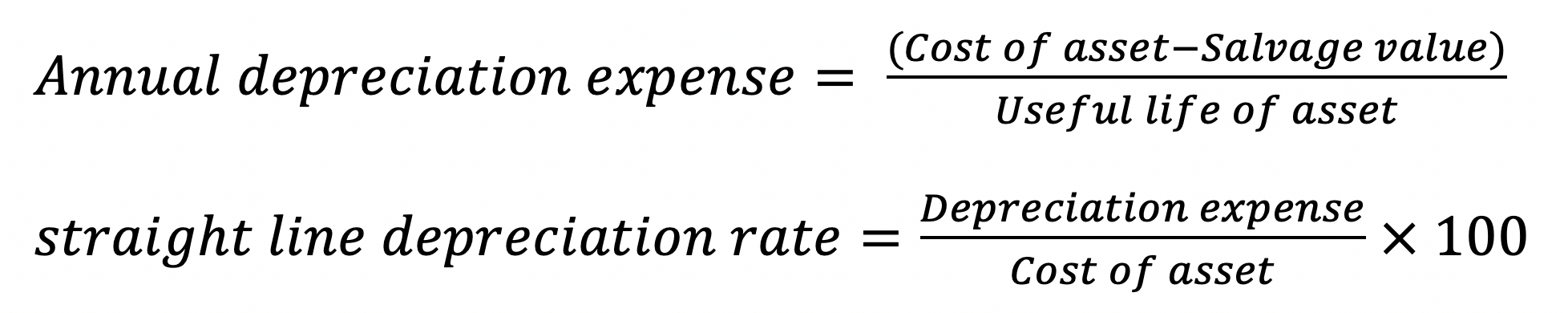

Depreciation rate 20 2 40 per year. Additionally the straight line depreciation rate can be calculated as follows. Taxpayers modified adjusted gross income is 195000 which is less than the 200000 statutory threshold.

Straight line depreciation percent 15 02 or 20 per year. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. Useful life 5.

It is the percentage charged as depreciation on the fixed asset. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

So we can refer schedule II and find out the useful life of respective depreciable asset. Firstly determine the total expense of the corporation which will be easily available as a line item just above the net income in its income statement. Calculation of amount of depreciation.

1 nth root of Residual ValueCost of the asset 100. Formula Calculation Problems and Solutions. Figure out the assets accumulated depreciation at the end of the last reporting period.

For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty transmission. First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate. Get 247 customer support help when you place a homework help service order with us.

Diminishing balance or Written down value or Reducing balance Method. The depreciation table is. To calculate the depreciation rate using straight-line depreciation you will need to determine a few things.

And the tax rate levied is 25. The machine hour rate is similar to the labour hour rate method and is used where the work is performed primarily on machines. The salvage value is Rs.

Company X considers depreciation expenses for the nearest whole month. This method evens out the profits and expenses at an equal rate using the straight-line. Now we need to calculate depreciation based on useful life.

The change in purchasing power. Firstly the taxable income of the individual and taxable earnings of the business entity is to be determined. This is calculated based on when the asset went into service and the preferred depreciation method.

The following formula determines the rate of depreciation under this method. Hence the calculation is as follows. 10 appreciation rateN number of years appreciation factor 10 00385 10385 121.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Following are examples where the depreciated amount is calculated using different methods. This formula is simply the tax rate multiplied by the taxable income of the business or individual.

But for now lets calculate the depreciation value of your furniture per. The accumulated depreciation divided by the current depreciation expense. Double Declining Balance Depreciation Method.

Depreciation Cost of Asset Net Residual Value Useful life 400000 400003 120000 pa. Percent Inflation Rate During Asset Life Annual. Factory overheadMachine hours If factory overhead is Rs 3 00000 and.

Determine the cost of the asset. The formula for a corporation can be derived by using the following steps. Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset.

Depreciation enables companies to generate revenue from their assets while only. Years Remaining Life of Assets. Here we will learn how to calculate Depreciation with examplesCalculator and downloadable excel template.

Single taxpayer with income less than the statutory threshold. The formula used in computing the rate is. Declining Balance Method Formula.

Next determine the net income of the corporation which will also be available as a line item in the income statement. We will talk more about determining each of those later on in this article. What is the Coefficient of Determination Formula.

Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. The most widely used method of depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. With Free Online Depreciation Calculation Tool you can calculate the total depreciation on a given asset using the Written Down ValueWDV method.

Find the future value. The cost of the furniture the salvage value and the useful life of the furniture. Examples of the Calculation of the Net Investment Income Tax 19.

Coefficient of Determination Formula Table of Contents Formula. Next determine the estimated manufacturing overhead cost for that level of activity in the forthcoming period. The rate of Depreciation Annual Depreciation x 100 Cost of Asset.

The formula for depreciation rate is 1- salvage value WDV as on 310320141 remaining period of useful life100. The formula for the predetermined overhead rate can be derived by using the following steps. Lets take an example to understand the calculation of the Straight Line Depreciation formula.

Firstly determine the level of activity or the volume of production in the upcoming period. In statistics coefficient of determination also termed as R 2 is a tool which determines and assesses the ability of a statistical model to explain and predict future outcomes. How to Calculate Straight Line Depreciation.

1 Straight-Line Method. You can use this rate to calculate an estimate of what the office space would be worth in five years.

How To Calculate Depreciation Youtube

Depreciation Calculation

How To Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Aasaan Io Blog

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

How To Calculate The Depreciation Of Currency Accounting Education

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula And Calculation Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping